6 Garage conversion ideas that add value and use to your home

Improve the environment and create one of the best rooms in your home. Many homeowners don’t think of their garage as an extension of their

Category:

Are you a first-time homebuyer who is looking to invest in property? If so, you are not alone. Many people invest in property instead of stocks or other traditional investments. While it can be a great way to build wealth over time, investing in property does come with some risks. This blog post will discuss ten tips for first-time home investors to help minimise those risks and make your investment experience as smooth as possible!

Before we dive in, it’s important to note that there is no guaranteed way to make money from investing in property. However, following these tips will help you make intelligent decisions that will put you in an excellent position to succeed.

Now, let’s get started!

The first step to any successful investment is research. You need to understand the market you’re entering and the specific property you’re interested in. What are similar properties selling for? What is the current rental market like in the area? These are just some of the questions you should be asking yourself.

An experienced real estate agent can be valuable for your research process. They can provide insights into the market and help you find properties that fit your investment goals.

Once you’ve done your research, it’s time to start developing a solid plan. What are your investment goals? Are you looking to generate income through rentals, or are you hoping to sell the property for a profit down the road?

It’s also essential to have a realistic timeline for your goals. Are you looking to make a quick investment and turn a profit within a year? Or are you willing to hold onto the property for longer to build long-term equity?

Property investment comes with some risks, so you must understand them before you start. For example, the value of your property could go down and up, so there’s always a chance you could lose money.

Investors who can think long-term and have a plan that extends beyond five years usually come out on top during market downturns. Property investment isn’t a get-rich-quick scheme – it’s a long-term investment that requires patience and perseverance. If you can stick to your plan and weather the storm, you’ll be in a much better position when the market rebounds.

If you’re planning on financing your investment property, getting pre-approved for a mortgage before you start shopping around is essential. This will give you a better idea of how much you can afford to spend and make the home buying process smoother and less stressful.

Tip #05: Have a Contingency Fund

When investing in property, it’s essential to have a contingency fund in place in case something unexpected comes up. This could be anything from an unanticipated repair to a drop in rent prices or interest hikes.

A contingency fund will give you peace of mind and help weather any bumps in the road. Aim to set aside at least three to six months of mortgage payments, so you’re covered no matter what happens.

When investing in property, it’s essential to diversify your portfolio, which means buying multiple properties in different locations.

Diversifying your portfolio helps minimise risk because it’s unlikely that all of your properties will decrease in value simultaneously. This strategy can also help you maximise your profits by allowing you to capitalise on market trends in different areas.

When investing in property, you need to factor in the ongoing costs associated with ownership. This includes mortgage payments, insurance, property taxes, and repairs/maintenance.

They can quickly eat into your profits if you’re not prepared for these costs. Before you buy an investment property, be sure to understand the individual costs for each property you’re considering. These costs can vary significantly from one property to the next, so it’s essential to know what you’re getting into before you make a purchase.

If you’re not prepared for the ongoing costs of property ownership, you could quickly find yourself in financial trouble. Make sure you have a realistic budget in place and be prepared to cover any unexpected expenses that may come up.

When you’re investing in property, it’s important to have a solid exit strategy in place. This is the plan you’ll use to sell or dispose of your investment when the time comes.

You make your money when you buy, not when you sell. Your exit strategy will be influenced by several factors, including your investment goals.

If your goal is to make a quick profit, you’ll need to plan a sale so you can capitalise on market conditions. However, if you’re willing to hold onto the property for a more extended period, you may be able to get a better price down the road.

No matter your goal, it’s essential to have a solid exit strategy in place so you can maximise your profits. Talk to your real estate agent or financial advisor to develop the best plan for you.

If you’re not planning on living in your investment property, you may consider hiring a property management company. These companies can take care of all the day-to-day tasks associated with owning rental property, Which can free up your time and allow you to focus on other things. Of course, there are costs related to hiring a property management company, but these can be offset by the increased profits you’ll earn from your rental property.

The real estate industry is constantly changing, so staying current on interest rates is essential. This will help you make the most of your investment and ensure you get the best return on your money.

You can stay up-to-date on interest rates by reading industry news and keeping an eye on market trends. You can also talk to your real estate agent or financial advisor to get more information about the current market conditions.

By following these tips, you can ensure you’re getting the most out of your investment. Just remember to do your research and consult with a professional before making any decisions. You can be a successful real estate investor with little planning and preparation.

Do you have any other property investment tips? Could you share them in the comments below?

Improve the environment and create one of the best rooms in your home. Many homeowners don’t think of their garage as an extension of their

We often hear the phrase “less is more.” But what does that mean? In sustainable design, we should strive to add as much function, life,

Subscribe to our newsletter and receive occasional updates about our inventions.

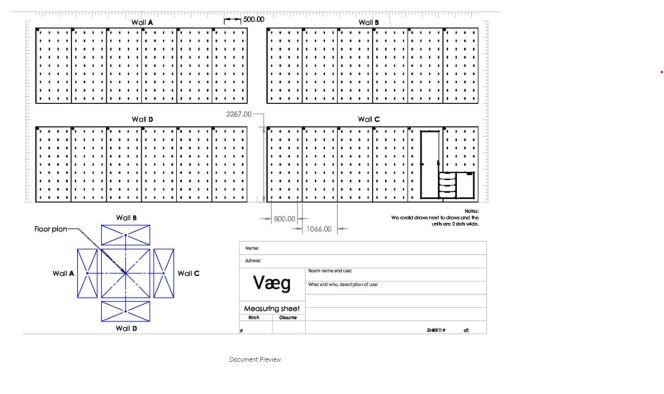

Important announcement. We have been busy developing a new industry-first process that puts you in control. Sketch it Send it and get We understand that

Vaegs is excited to introduce the latest release in their 430 joinery range. This new line has been under development for several months, and we’re

I am excited to announce that the trademark application for Vaeg has been accepted! This is a huge milestone for our company, and we would

Property investing can be a great way to create wealth and financial security for you and your family. However, it is important to learn as

Do you work from home? If so, you know the importance of having a dedicated space for your office. Not only does it help you

Improve the environment and create one of the best rooms in your home. Many homeowners

Are you a first-time homebuyer who is looking to invest in property? If so, you

We often hear the phrase “less is more.” But what does that mean? In sustainable

Subscribe to our newsletter and receive occasional updates about our inventions.

Important announcement. We have been busy developing a new industry-first process that puts you in

Vaegs is excited to introduce the latest release in their 430 joinery range. This new

“Give a man a fish and you feed him for a day, teach a man to fish and you feed him for a lifetime?” – we’re giving.

4 thoughts on “10 Property Investment Tips for First-Time Homeowners”

It’s really important to know these ideas for investors can refer through – save time and money.

Investing in property is a good move that everyone should follow through.

I am very thankful to you for this blog because its give me lot of knowledge.

Thanks for your feedback, It may motivate me to create more blog posts.